From cost-cutting to value creation

Updated on

December 17, 2025

Reading time

5 minute read

From cost-cutting to value creation

⚡ Quick Answer

Private equity firms can create value beyond cost-cutting by embracing brand-led growth strategies. Typically, integrating brand considerations into due diligence, investment planning, and portfolio management unlocks revenue growth, pricing power, and customer loyalty. Strong brands serve as strategic assets that enhance sustainable returns and competitive advantage, making brand investment a key driver of long-term value creation in PE.

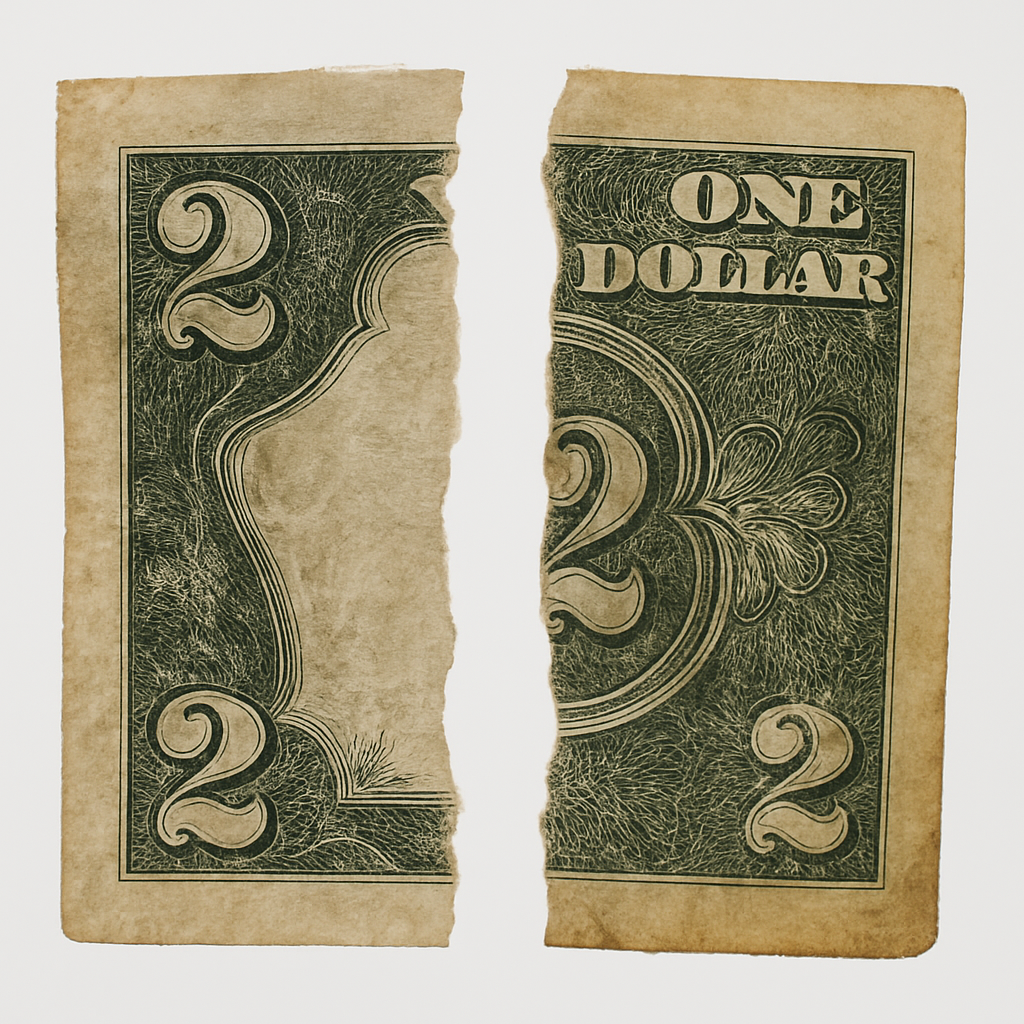

From cost-cutting to value creation: rethinking private equity strategies

In the world of private equity (PE), the traditional approach has long centered on cost-cutting as a primary driver of value. While operational efficiency remains important, this narrow focus often overlooks a critical and powerful lever for growth: the brand. Shifting from an efficiency-driven mindset to one that embraces Brand-led value creation Can unlock significant new opportunities for revenue, pricing power, and customer loyalty, ultimately leading to stronger, more sustainable investment returns.

Why traditional PE playbooks fall short

Historically, private equity firms have prioritized cost reduction, operational improvements, and financial engineering as the main pathways to enhancing portfolio company value. These methods can deliver quick wins and improve margins, but they rarely capture the full value potential embedded within the business. Cost-cutting alone is often a finite resource — once inefficiencies are eliminated, returns plateau and growth stalls.

Moreover, an excessive focus on cost can sometimes erode the very assets that support long-term competitiveness, such as customer relationships, employee engagement, and brand equity. This approach may result in underinvestment in marketing, innovation, and customer experience, areas that are essential for establishing a differentiated market position.

The power of branding as a value multiplier

Branding is more than just a logo or tagline — it is the promise a company makes to its customers and the emotional connection it fosters. Strong brands create tangible financial value by:

- Increasing pricing power: Brands that command trust and loyalty can often charge premium prices, improving margins without sacrificing volume.

- Driving revenue growth: Well-positioned brands attract new customers more easily and support higher conversion rates throughout the sales funnel.

- Deepening customer loyalty: Strong brands cultivate repeat business and long-term relationships, reducing churn and lowering customer acquisition costs.

Beyond these benefits, brands serve as Strategic assets With multiplier effects across marketing, sales, and product development. Brand strength can also create resilience during economic downturns and competitive pressure, protecting the portfolio company’s market share and profitability.

Evidence: strong brands outperform market indices

Multiple studies underscore the financial advantages of investing in brand strength. For example, the Interbrand best global brands Report consistently shows that companies with strong, enduring brands outperform their peers in stock market returns. Similarly, the brandz top 100 most valuable global brands report demonstrates that brand equity significantly contributes to a company’s overall valuation.

Private equity firms that integrate brand considerations into their investment thesis often achieve superior exit multiples. For instance, brands like Apple and Nike have consistently commanded premium valuations thanks to their loyal customer bases and unparalleled Brand equity. This proves that branding isn’t just a marketing expense — it’s a strategic investment that drives value creation.

Actionable steps: embedding brand into due diligence and strategy

To harness the power of brand-led value creation, private equity firms should embed brand considerations throughout the investment lifecycle:

- Due diligence: Incorporate brand audits and customer perception analyses to assess the strength and potential of the brand. Evaluate brand risks, competitive positioning, and growth opportunities linked to brand equity.

- Investment thesis development: Define how brand-building initiatives will contribute to revenue growth, pricing strategies, and customer retention. Align operational improvements with brand enhancement efforts.

- Post-acquisition strategy: Prioritize investments in marketing, innovation, and customer experience. Foster a brand-centric culture within the portfolio company, ensuring consistent messaging and customer engagement.

- Performance measurement: Track brand health metrics such as net promoter score (NPS), brand awareness, and market share alongside traditional financial kpis to build a comprehensive picture of value creation.

Additional q&a: deepening understanding of brand-led value creation

Q: how can PE firms quantify the impact of brand on financial performance?

A: While measuring brand value can be complex, firms can use a combination of qualitative and quantitative metrics. Brand-related kpis — like customer lifetime value, price premium, and retention rates — provide direct insights. Additionally, independent Brand valuation methods (e.G., interbrand, brandz) estimate brand equity as a portion of enterprise value. Combining these data points with scenario modeling can help quantify brand impact on potential returns.

Q: what are some common pitfalls when attempting to build brand value in a PE portfolio?

A: One common mistake is treating Brand-building as a cost center Rather than a strategic growth lever. Skimping on marketing budgets or ignoring customer experience can undermine brand strength. Another pitfall is failing to align branding initiatives with core business strategy and operational realities. Without clear objectives and governance, brand investments may be inconsistent or ineffective.

Q: can brand-led strategies work in highly commoditized or B2B industries?

A: Absolutely. Even in commoditized or industrial sectors, Strong brands can differentiate offerings Through reputation for quality, service, or innovation. In B2B markets, branding also plays a vital role in building trust and long-term partnerships. Examples include companies like caterpillar and IBM, whose brand equity supports higher margins and sustained customer loyalty despite intense competition.

Q: how can private equity firms develop in-house branding expertise?

A: PE firms can build internal capabilities By hiring brand strategists or partnering with specialized agencies. Training deal teams on brand assessment frameworks and integrating brand reviews into investment committee processes are also effective. Over time, firms can embed brand thinking into their culture, making it a routine part of decision-making.

Conclusion

For private equity firms seeking to maximize value creation, Moving beyond traditional cost-cutting and embracing brand-led growth Is essential. By recognizing brand as a strategic asset and embedding brand considerations into due diligence, investment theses, and portfolio management, firms can unlock sustainable competitive advantages. Ultimately, this shift will not only drive stronger financial returns but also build companies that thrive well beyond the investment horizon.