The differentiation trap

Updated on

December 28, 2025

Reading time

6 minute read

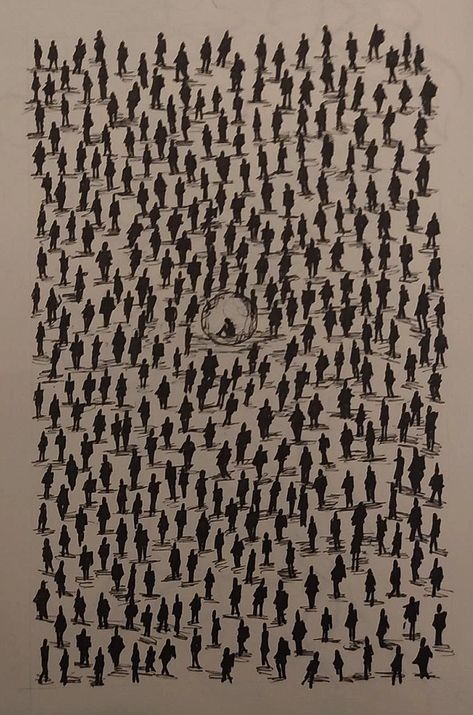

The differentiation trap

Stand out. Be different. Carve out a unique position. Don’t be a commodity.

This is the gospel of modern branding, repeated so often it feels like natural law. Differentiation is good. Sameness is death. The brands that win are the brands that are most distinctive.

Except when they’re not.

The reality is messier than the gospel suggests. Differentiation isn’t always an asset. Sometimes it’s a liability. Some brands succeed by being similar. Some categories punish distinctiveness. The obsession with standing out can become its own trap—a strategic misdirection that burns resources and alienates customers.

Understanding when differentiation helps and when it hurts is more useful than blindly pursuing distinctiveness.

The case for differentiation

The standard logic for differentiation is sound, as far as it goes.

In crowded markets, attention is scarce. A brand that looks like every other brand fades into the background. Distinctiveness creates memorability—you’re easier to recall when you’re easy to recognize. This drives the “be different” imperative.

Differentiation also enables premium pricing. If you’re interchangeable with competitors, you compete on price. If you’re offering something unique, you have pricing power. The brand becomes a moat.

And differentiation attracts right-fit customers. When you stake out a clear position—”we’re for this kind of person, not that kind”—you filter effectively. Right-fit customers see themselves in your brand. Wrong-fit customers self-select out. Sales efficiency improves.

This logic is real. It explains why differentiation became orthodoxy. But it’s incomplete.

When differentiation fails

Differentiation can fail in several ways.

Differentiation for its own sake. Some brands differentiate on dimensions that don’t matter to customers. They’re proudly distinctive in ways that nobody cares about. The brand team loves the unique positioning. The market is indifferent.

This happens when differentiation becomes an internal game—a creative exercise disconnected from customer needs. The question “how are we different?” replaces the question “what do customers actually want?” The brand becomes distinctive but irrelevant.

Differentiation that signals unfamiliarity. In some categories, sameness is a trust signal. Banks look like banks. Law firms look like law firms. Hospitals look like hospitals. This isn’t lack of imagination—it’s appropriate signaling.

When the stakes are high and the purchase is infrequent, customers look for reassurance. Familiar visual language says “we’re legitimate, we know how this works, you can trust us.” Radical differentiation in these contexts can backfire—it signals that something is off, that maybe this isn’t a real player.

Differentiation that increases cognitive load. Every unfamiliar element requires mental processing. A brand that’s radically different asks more of customers—more attention, more interpretation, more effort to understand what they’re looking at.

In categories where the purchase decision is low-involvement, this added friction can cost you. Customers aren’t looking to be challenged or intrigued. They’re looking to check a box quickly. The unfamiliar brand gets skipped.

Differentiation that limits your market. Strong differentiation often means strong exclusion. “We’re for creatives, not corporates.” “We’re premium, not accessible.” “We’re playful, not serious.” Each distinctiveness claim is also a claim about who you’re not for.

Sometimes this is correct strategy—focus on a segment and own it. But sometimes it prematurely limits your market. The distinctiveness that attracted your first customers becomes a barrier to your next ones.

The similarity opportunity

While brands obsess over differentiation, there’s often opportunity in strategic similarity.

Category conventions create efficiency. If every saas product page has pricing tiers, feature comparisons, and customer testimonials, there’s a reason. These patterns work. Customers know how to process them. Matching the convention lets you compete on what matters—the actual offering—rather than making customers work to understand your unfamiliar structure.

Similarity can signal legitimacy. A new entrant that looks like established players borrows their credibility. “We’re like X, but Y” is a powerful positioning format because it uses similarity to establish baseline trust, then differentiation to show improvement.

Strategic sameness preserves optionality. The more distinctive your brand, the harder it is to evolve. Strong differentiation can lock you into a position that becomes a constraint. Moderate distinctiveness—recognizable but not radical—gives you room to adapt.

Fast-followers thrive on similarity. Some of the most successful companies deliberately embrace similarity. They let first-movers establish the category, then enter with a refined version of the same thing. Their brands are intentionally conventional. Their success comes from execution, not distinction.

Finding the right level

The question isn’t whether to differentiate, but how much and on what dimensions.

Differentiate on what matters. The relevant question is: what do customers use to make decisions? Differentiate on those dimensions. A coffee brand might need distinctive flavor and sourcing; visual identity might matter less. A fashion brand might need distinctive aesthetics; functional messaging might matter less. Match your differentiation to your category’s decision drivers.

Match risk tolerance to stakes. High-stakes purchases (financial, medical, legal) warrant conservative branding that signals trustworthiness. Low-stakes purchases allow more experimentation. The higher the stakes, the more customers want reassurance over novelty.

Consider category maturity. In new categories, differentiation is easier—there’s no established pattern to follow. In mature categories, differentiation requires more effort and carries more risk. The calculus is different.

Evaluate your resources. Building distinctive brand awareness requires sustained investment. If you can’t fund the long effort to make a distinctive brand recognizable, strategic similarity might be more efficient. Distinctiveness as an underfunded aspiration is the worst of both worlds.

The practical framework

Before reflexively pursuing differentiation, ask these questions.

What actually matters to customers in this category? Am I differentiating on those dimensions, or on dimensions I find interesting but customers don’t?

What does similarity signal in this category? Is the conventional look a trust signal i’m giving up? What do I lose by looking different?

How much cognitive work am I asking of customers? Is my differentiation making the decision easier or harder? Am I adding friction they won’t tolerate?

What’s my investment horizon? Can I fund the sustained effort to make distinctive positioning recognizable? Or will I run out of runway before distinctiveness pays off?

What’s my strategic scope? Does strong differentiation limit the market I can address? Am I creating a ceiling that will constrain growth?

Beyond the binary

The differentiation trap is the belief that distinctiveness is always good and sameness is always bad. Reality is more nuanced.

The best brands find what might be called “relevant differentiation”—distinctive on dimensions that matter, conventional on dimensions that don’t. They stand out enough to be memorable without working against themselves. They use similarity strategically, not out of laziness but out of understanding.

The goal isn’t maximum differentiation. It’s appropriate differentiation—the right amount, on the right dimensions, for your category, your customers, and your resources. Sometimes that means being radically different. Sometimes it means being strategically similar.

The trap is thinking there’s only one right answer.